Information

Introduction to Malaysia

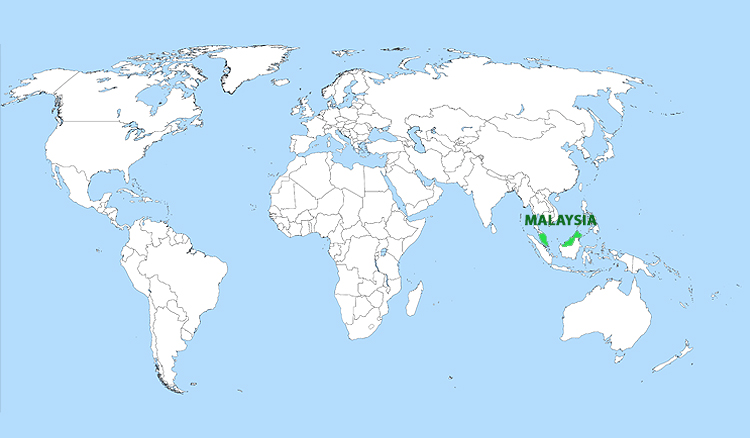

Malaysia is made up of thirteen States and three Federal Territories. The capital city is Kuala Lumpur, and Putrajaya is the seat of the Federal Government. The current population stands at over 34 million. Geographically, the country is separated into two regions. Eleven States and two Federal Territories are located in Peninsular Malaysia in the southern most tip of the Asian Continent and two states and one Federal Territory are located in the Island of Borneo. Malaysia borders Thailand, Indonesia, Singapore, Brunei and the Philippines.

Geographical Facts

Geographic coordinates: 2 30 N, 112 30 E

Map references: Southeast Asia Area: total: 329,750 sq. km land: 328,550 sq. km water: 1,200 sq. km Area – comparative: slightly larger than New Mexico

Area : total: 329,750 sq. km land: 328,550 sq. km water: 1,200 sq. km

Population: About 32.7 million (2022).

Land boundaries: total: 2,669 km border countries: Brunei 381 km, Indonesia 1,782 km, Thailand 506 km

Coastline: 4,675 km (Peninsular Malaysia 2,068 km, East Malaysia 2,607 km)

Maritime claims: continental shelf: 200-m depth or to the depth of exploitation; specified boundary in the South China Sea exclusive economic zone: 200

Climate: tropical; annual southwest (April to October) and northeast (October to February) monsoons

Terrain: coastal plains rising to hills and mountains Lowest point: Indian Ocean 0 m Highest point: Gunung Kinabalu 4,100 m

Natural resources: petroleum and natural gas, timber, tin, iron ore, bauxite, gold, coal

Land use: arable land: 3% permanent crops: 12% permanent pastures: 0% forests and woodland: 68% other: 17% Irrigated land: 2,941 sq. km

Natural hazards: floods and landslides are two common hazards

Environment – current issues: air pollution from industrial and vehicular emissions; water pollution from raw sewage; deforestation; smoke/haze from neighboring countries forest fires.

Mining Business Guidelines

GUIDELINES TO DOING MINING BUSINESS IN MALAYSIA

OVERVIEW

Malaysia is the fourth largest economies in South East Asia. It’s estimated around 34 million populations increasingly prosperous, making it a growing market with considerable potential.

Malaysia is endowed with over 33 different mineral types, comprising metallic, non-metallic and energy minerals, worth several billion dollars in economic potential. It provides a great opportunity to those who see to venture into this area. Trade and trade-related policies remain integral parts of Malaysia’s broad economic development strategy, whose key objectives are economic growth sufficient for the attainment of developed country status.

MINERAL POLICY

The mining industry comes under the purview of the Ministry of Natural Resources and Environmental Sustainability (NRES). However, as mining activity involves land which is State matter, the approval for mining related applications is empowered to the respective States in consultation with the federal agencies under the purview of NRES such as the Department of Mineral and Geosciences (DMG). The Federal Government in 1998, established a National Mineral Council (NMC) to coordinate mineral related matters, co-operation between the Federal and State Governments and oversee the overall integrated development on the mineral industry.

To spearhead the country’s mineral resource industry going forward, the Federal Government has formulated the National Mineral Policy 2 (NMP2) in January 2009, a revised version of the earlier Policy formulated in 1994 The NMP2 provides the foundation for the development of an effective, efficient and competitive regulatory environment for the mineral sector. The thrust of the policy is to expand and diversify the mineral sector through optimal exploration, extraction and utilisation of resources using modern technology supported by Research and Development (R&D).

The salient features of the NMP2 are the provisions for the security of tenure, high land-use priority for mining, uniform and efficient institutional framework, regulations and guidelines. Under the NMP2, emphasis is also given to rehabilitation, environmental protection, sustainable development and the management of social impacts. The country’s environmental aspects of mine development are regulated by the Environmental Quality (Prescribed Activities) (Environmental Impact Assessment) Order 1987, which is a subsidiary legislation to the Environmental Quality Act of 1974. Under order 1987, a mining lease application for mining leases that are larger than 250 hectares must include and environmental protection plan that is approved by the DOE.

View National Mineral Policy 2 (NMP2)

View National Mineral Industry Transformation Plan (TIM) 2021 – 2030

LEGISLATIONS

FORMATION AND ADMINISTRATION OF COMPANIES

Essential requirements of a company

A company shall have;

- A name;

- One or more members, having limited or unlimited liability for the obligations of the company;

- In the case of a company limited by shares, one or more shares; and

- One or more directors.

Types of companies

- A company may be incorporated as;

- A company limited by shares;

- A company limited by guarantee; or

- An unlimited company.

- A company is limited by shares if the liability of its members is limited to the amount, if any, unpaid on shares held by the members.

- A company is limited by guarantee if the liability of its members is limited to such amount as the members undertake to contribute in the event of its being wound up.

- A company is an unlimited company if there is no limit on the liability of its members.

Private or public company

- A company limited by shares shall either be a private company or a public company.

- A company limited by guarantee shall be a public company.

- An unlimited company shall either be a private company or a public company.

Prohibition on companies limited by guarantee with a share capital

No company shall be formed as, or become, a company limited by guarantee with a share capital.

Prohibition for unincorporated associations, Etc.

No association or partnership consisting of more than twenty persons shall be formed for the purpose of carrying on any business for profit, unless it is incorporated as a company under this Act, or is formed under any other written laws.

MINING LEGISLATION

The two main legal instruments that govern activities relating to mining are the Mineral Development Act (MDA) 1994 and the various State Mineral Enactments (SME). The MDA came into force in August 1998. Each State has its own legislation governing mining activities.

Mineral Development Act (1994) (MDA)

The MDA defines the powers of the Federal Government on matters pertaining to the inspection and regulation of mineral exploration, mining and other related issues. The legislation is enforced by the Department of Mineral and Geosciences of Malaysia.

State Mineral Enactment (SME)

The SME empowers the States the rights to issue mineral prospecting and exploration licences and mining leases. The administration of the legislation is undertaken by the office of the State Director of Land and Mines (PTG). As at end of 2021, all the states, except Sabah, have adopted the SME.

The SME have in common, several distinguishing features, which are conducive to mineral investment, as follows;

- One-stop-centre

Administration is centralised at the office of the SDLM for lodging applications for prospecting / exploration licenses and mining leases and for up keep of information on mineral tenements, including areas subject to applications.

- State Mineral Resources Committee

A State Mineral Resources Committee (SMRC) is established to coordinate vetting of applications for prospecting / exploration, and submits recommendation to the State Authority for a decision pertaining to licenses and mining leases and other mineral tenements.

Members of the SMRC comprise:- Chairman – appointed by the State Authority;

- State Legal Advisor or his representative;

- State Director of Land and Mines – as the Secretary;

- Director General of the Department of Mineral and Geosciences or his representative;

- Director General of the Department of Environment or his representative;

- Director General of the Department of Forestry or his representative;

- Director of State Economic Planning Unit or his representative; and

- Three other members to be appointed by the State Authority.

Process Flow – Applications for prospecting/exploration licenses and mining leases

Under the SME, a prospecting license, exploration license and mining lease may be granted to;

- A person;

- A company;

- A body expressly empowered to hold mining land under any other written law of Malaysia; and

- A foreign company as defined in the relevant legislation relating to companies, registered under the said legislation and authorized by its constitution to hold mining land.

The issuance of licenses and leases by the State is subjected to certain conditions and restrictions as prescribed under the SME, as follows;

Prospecting/Exploration License:

| Prospecting License | Exploration License | |

|---|---|---|

| Area for exploration work | 25-400 hectares | 400-20,000 hectares |

| Valid period | Maximum 2 years | Maximum 10 years |

| Extension period | + 2 years | + 5 years |

| Application for renewal | Not later than 6 months prior to expiry of the License | Not later than 12 months prior to expiry of the License |

Small scale mining operation/large scale mining operation:

| Small scale operation | Large scale operation | |

|---|---|---|

| Target for mining | Alluvial | Hard rock |

| Area for mining lease | Such size as reasonably required for the mine | Such size as reasonably required for the mine |

| Requirement for EIA | Areas more than 250 hectares | Areas more than 250 hectares |

| Duration of mining lease | Estimated life of the ore body to be mined or 21 years whichever is shorter | Estimated life of the ore body to be mined or 21 years whichever is shorter |

| Term of renewed mining lease | Estimated remaining life of the ore body or 21 years whichever is shorter | Estimated remaining life of ore body or 21 years whichever is shorter |

| When to apply for renewal | 12 months prior to expiry of the lease | 12 months prior to expiry of the lease |

The SME provides an attractive, efficient, harmonious and stable mineral regulatory framework that is conducive to the development of the industry. It was enacted replacing existing laws to cover conditions allowing not only for small scale and labor intensive mining but also for large scale exploration and capital intensive modern mining that the country anticipates in the future.

FISCAL REGIMES

Equity Participation:

Foreign investors undertaking mineral explorations and mining in Malaysia may be permitted to control 100% equity, and may also form joint ventures with local companies.

Incentives:

Amongst some of the incentives that have been accorded to the mineral sector includes abolishment of export duty on most minerals. Most raw minerals, including ores and concentrates, are subject to low or zero level import duty. For those minerals still subject to import duty, the importer may apply to the Government for a waiver. Imported equipment for use in mineral projects are subject to the general schedule of import tariffs but an application for a waiver may be made on a case-by-case basis.

Taxation:

A business entity incorporated in Malaysia, whether resident or not, is assessable on income accrued in or derived from Malaysia. The Government has reduced corporate tax from 28 per cent in 1998 to 24 per cent in 2021. This move has helped to reduce further the cost of doing business and accorded companies with greater capacity to expand capital spending.

Royalty:

Apart from paying corporate tax to the Federal Government, mine operators also pay value-based royalty to the State where their mining operation is located. Royalty rate varies from 2.5% to 12% ad valorem depending on the commodity and as assessed by each of the individual States.

INVESTMENT ENVIRONMENT

Apart from supportive Government policies, well developed and uniform regulatory framework and attractive fiscal regimes, Malaysia’s market oriented economy, strategically located in the heart of South East Asia, offers a cost-competitive and conducive business environment which is the ideal prerequisite for growth and profits.

Infrastructure:

The country has a well developed network of good highways and railways, well-equipped seaports and airports and high quality telecommunications network and services.

Utilities:

Competitive electricity tariff rates and reliable service are provided by:

- Tenaga Nasional Berhad (TNB) in Peninsular Malaysia.

- Sabah Electricity Sdn. Bhd. (SESB) in the State of Sabah and the Federal Territory of Labuan, Malaysia’s international offshore financial centre.

- Sarawak Electricity Supply Corporation (SESCO) in the State of Sarawak.

Workforce:

The country has talented, educated and productive and multilingual workforce speaking two or three languages, including English. It also has a comprehensive system of vocational and industrial training, including advanced skills training and mining related graduates from local universities such as University Malaya, University Kebangsaan Malaysia, University Malaysia Sabah, University Malaysia Kelantan, University Malaysia Perlis, and University Sains Malaysia. In addition, industrial relations is generally harmonious with minimal trade disputes.

Quality of Life:

- Friendly and hospitable Malaysians.

- Safe and comfortable living environment

- Excellent housing, modern amenities, good healthcare and medical facilities

- Excellent educational institutions including international schools for expatriate children

- World-class recreational and sports facilities

- Excellent shopping with goods from all over the world

SOURCES:

- Law of Malaysia, Act 777, Companies Act 2016 (http://www.federalgazette.agc.gov.my/)

- Invest in Malaysia, Your Profit Center in Asia published by Malaysian Industrial Development Authority (MIDA) 2021.

- The State Mineral Enactment: Meeting Investor’s Needs by Dato’ Haji Zulkifly Abu Bakar, Department of Mineral and Geosciences Malaysia

Recent Mineral Industry Performance

Overview

Malaysia’s mineral resource industry can broadly be divided into three sectors, namely the metallic, non-metallic, and energy mineral sectors. The metallic mineral sector produces minerals such as tin, gold, bauxite, iron ore, ilmenite, manganese and other associated mineral by-products of tin and gold mining such as zircon, monazite, rutile, struverite and silver. The non-metallic mineral sector produces limestone, clays, kaolin, silica sand, sand and gravel, aggregates, feldspar and mica. The energy mineral sector produces only coal.

Malaysia’s mineral production saw notable development in 2023, particularly in the mining of ion adsorption clay-type rare earth elements even though still on a pilot scale. Year-on-year, Malaysia achieved an impressive 6.8 per cent increase in value of minerals produced from RM8.10 billion in 2022 to RM8.65 billion in 2023. Tin, bauxite, feldspar, kaolin, limestone, mica, sand and gravel, silica sand and coal showed increase in production, with bauxite showing more than a four-fold increase. Gold, ilmenite, iron ore, manganese, aggregates and clay declined in production.

The mining sector continued to play an important role in supplying basic raw materials to the construction and manufacturing sectors for Malaysia’s economic development, remained important to the country’s economy.

Mineral Resources

METALLIC MINERALS

Tin

Tin ore continued to be mined but not as much as in the past glorious years of the 70s and 80s when Malaysia was the world’s largest tin ore producer. High grade deposits have inevitably been exhausted following decades of tin mining. Competition from other economic sectors, such as agriculture, plantations, property and industrial developments, over land use have made them now less available for mining. Most of the tin ore produced during the year came from mines located in Perak, Selangor and Pahang.

Bauxite

Production of bauxite was mostly from mines in the state of Pahang. There is also mine in the states of Johore. They were mining leases issued under the State Mineral Enactment (SME). There were also bauxite produced from mines with passes issued under the National Land Code and also from illegal mines of which their total production could not be ascertained. According to the Department of Mineral and Geoscience (JMG), there are potential resources of bauxite in other parts of Malaysia, such as in the states of Sarawak and Sabah.

Gold

Malaysia’s production of gold comes from the three states, namely Kelantan, Pahang and Sabah. The major gold producers were the CMNM Sokor Gold project in Kelantan, the Penjom gold mine in Pahang and the Bukit Mantri gold mine in Sabah. Most of these large gold mines are joint-ventures between local and foreign interests. According to the Department of Mineral and Geoscience (JMG), several prospective gold deposits are found in other States, such as Negeri Sembilan, Johore, Perak and Sarawak.

Ilmenite

Ilmenite comes mainly from the processing of ‘amang’ from alluvial tin. Since the closure of the only primary ilmenite mine located in Terengganu in 2003 due to exhaustion of high grade reserves, production today comes mainly from amang retreatment plants in Perak and Selangor. There have also been large imports of ilmenite for use by domestic consumers and re-exports.

Iron Ore

Iron ore mines in Malaysia can be located in the states of Pahang, Johore, Perak, Kelantan, Kedah and Terengganu. These iron-ore were of low grade that came mostly from mines with small reserves. Besides export, the iron-ore were consumed by the local cement, and iron and steel plants. Malaysia’s steel industry also imports iron-ore for their manufacturing requirements in the form of lumps and pellets, mainly from Brazil, Chile and Bahrain.

Manganese

Manganese ore is an important raw material in iron and steel production. It is essential by virtue of its sulphur-fixing, deoxidizing and alloying properties. Besides a variety of other uses, manganese is also used in producing aluminium alloys and dry cell batteries.

Deposits of manganese have been found in Kelantan, Terengganu, Pahang and Johore with total ore resource amounting to some 3.7 million tonnes. The grades are mostly 50 per cent Mn or below.

NON-METALLIC MINERALS

Aggregates

Malaysia have abundant resources of aggregates located in the states of Perak, Selangor, Johore, Sabah and Sarawak. Aggregates production in Malaysia comes from two primary sources, namely quarries and river beds, with the former consisting mainly of granite and limestone. These aggregates are the primary construction materials used for the many on-going infrastructure and mega projects throughout the country.

Clay

Malaysia’s clays comprise common clay, ball clay, fire clay, shale, laterite and red earth. They are used mainly in making bricks, ceramic wares, cement and also for landfill. The country has abundant clay resources with deposits located in the States of Pahang, Selangor, Terengganu, Kelantan, Perak, Kedah, Pulau Pinang, Negeri Sembilan, Johore and Sarawak.

Feldspar

Feldspar resources in Malaysia are limited. They are found in the states of Negeri Sembilan, Perak, Johore, Kedah, Pahang and Kelantan. There are four types of feldspar but only the potassium and sodium feldspar have economic value. They are used mainly in the production of glass, ceramics and mild abrasives.

Kaolin

Malaysia have sizeable reserves of kaolin located in the states of Perak, Johore, Kelantan, Selangor, Pahang and Sarawak. However, mining for kaolin are being carried out only in Perak, Pahang and Johor. Kaolin is used mainly as paper coatings and fillers, and in the manufacturing of ceramics, paints, rubber, plastics and chemical products.

Limestone

Malaysia have abundant limestone resources. Some 12,000 million tonnes of limestone reserves have been identified by Department of Mineral and Geoscience (JMG) located in the states of Perlis, Kedah, Perak, Selangor, Negeri Sembilan, Pahang, Kelantan, Sabah and Sarawak. Limestone is used in the manufacture of cement, and also for producing marble dimension stone and other limestone based products.

Mica

Mica is a group of silicate minerals comprising varying amounts of aluminium, potassium, magnesium, iron and water. The mica produced in Malaysia is sericite, which is a fine-grained muscovite mica. The crude fine flakes are recovered from schistose rocks by screening according to the required grain size, either by wet or dry process. They are then further processed into various sizes of ground mica (sericite) powder. Sericite is used in industrial applications such as fillers in paints and cosmetics, as mould lubricant in the rubber industry, fluxing agent in welding electrodes and reinforcement in plastics.

Mica producers are located in Bidor, Perak and operating on ex-tin mining land. Most of Malaysia’s mica production are exported to Japan, Thailand, Taiwan and South Korea.

Sand & Gravel

Malaysia have abundant sand and gravel resources, which are mainly derived from rivers, alluvium, offshore areas and mine tailings located throughout the states of Perak, Kedah, Johore, Selangor and Sarawak. Sand and gravel are also important raw materials for the construction and infrastructure industries.

Silica Sand

Silica sand resources in Malaysia are abundant. They comprise largely of natural sand deposits and ex-tin mine tailings. The Department of Minerals and Geoscience (JMG) has estimated that the country has some 148.4 million tonnes of silica sand reserves located in the states of Johor, Perak, Terengganu, Kelantan, Sabah and Sarawak. Production of silica comes from several active sand mining operations in Johore, Perak and Sarawak. Most of the silica are used in the manufacture of glass products and to a lesser extent in the production of ceramics, foundries, glass wool and water treatment materials.

ENERGY MINERAL

Coal

Malaysia’s coal resources are located primarily in the states of Sarawak and Sabah with smaller occurrences in the states of Selangor, Perak and Perlis. Reserves estimated by Department of Minerals and Geoscience (JMG) amounts to some 1,724 million tonnes, of which 275 million tonnes are measured, 347 million tonnes indicated and the balance of 1,102 million tonnes as inferred.

Percentage wise, some 80 per cent of these resources are in Sarawak, 19 per cent in Sabah and one per cent in Peninsular Malaysia. The largest reserves of coal are located in Merit Pila, Sarawak and in Maliau and Malibau, Sabah.

Malaysia import large quantities of coal for its domestic requirements. Its major import source countries are Indonesia, Australia and China. The imported coal are consumed mainly by the power generation and cement plants and to a lesser extent by the iron and steel plants. Coal is one of Malaysia’s current domestic energy mix under its Five-Fuel Policy comprising oil, gas, hydro power, coal and renewable energy.

Policy

NATIONAL MINERAL POLICY

The mining and quarrying sector is now under the purview of the Ministry of Natural Resources and Environmental Sustainability (NRES). The Government established a National Mineral Council (NMC) in 1998 to oversee the overall integrated development of the mineral industry and to assure such development would meet its policy objectives. The National Mineral Council is also charged with coordinating relations between the Federal and State Governments on matters concerning the industry.

To spearhead the developments of the country’s mineral resource industry, the Government formulated a National Mineral Policy (NMP) in 1994. This NMP was revised in 2009 to National Mineral Policy 2 (NMP2).

The NMP2 provides the foundation for the development of an effective, efficient and competitive regulatory environment for the mineral sector. The objectives are as follows:

- To ensure the sustainable development and optimum utilisation of mineral resources.

- To promote environmental stewardship that will ensure the nation’s mineral resources are developed in an environmentally sound, responsible and sustainable manner.

- To enhance the nation’s mineral sector competitiveness and advancement in the global arena.

- To ensure the use of local minerals and promote the further development of mineral-based products.

- To encourage the recovery, recycling and reuse of metals and minerals.

View National Mineral Policy 2 (NMP2)

Recognising the need for modernisation, discussions to formulate National Mineral Policy 3 (NMP3) began in early 2023. NMP3 was crafted to align with the primary objectives of the National Mineral Industry Transformation Plan (TIM) 2021‑2030 that was to increase the local mineral industry’s contribution to the national Gross Domestic Products (GDP).

Prepared by the then Ministry of Natural Resources, Environment and Climate Change (NRECC) [now known as the Ministry of Natural Resources and Environmental Sustainability (NRES)], the key objectives of NMP3 are to:

-

- Improve the efficiency of the country’s mineral industry.

- Develop the entire mineral industry value chain through optimal use of mineral resources.

- Strengthen the use of high technology in the country’s mineral industry.

- Enhance the competitiveness and progress of the country’s mineral industry at the regional and international levels.

- Develop the mineral industry in a balanced way between economic progress, environmental sustainability and the well-being of the people.

The NMP3 framework has 5 Cores namely:

CORE 1: Empowerment of Legal and Industrial Environment

CORE 2: Strengthening the Entire Industrial Value Chain

CORE 3: Advancement of Technology in Industry

CORE 4: Development of Expertise and Skills in Human Capital

CORE 5: Emphasis on Environmental, Social and Governance (ESG) Principles

These five core areas are supported by 26 Strategies for the implementation of the policy.

The NMP3 framework has been approved by the Cabinet in 2024. Currently, the related action plans are being finalised. An engagement session for the preparation of the action plans was hold when previously. NRES shall hold another engagement session with relevant agencies/parties to refine the action plans.

Legislation

MINERAL LEGISLATIONS

In Malaysia, activities relating to “mineral” and “rock material” are governed by separate laws.

“Mineral” means any substance whether in solid, liquid or gaseous form occuring:

- naturally;

- as a result of mining in or on the earth; or

- as a result of mining in or under the sea or seabed,

formed by or subject to a geological process, but excludes water, “rock material” as defined in the National Land Code and “petroleum” as defined in the Petroleum Mining Act 1966.

The two main legal instruments that govern activities relating to “mineral” are the Mineral Development Act, 1994 and the State Mineral Enactment. The Mineral Development Act came into force in August 1998.

The Mineral Development Act 525 of 1994 defines the powers of the Federal Government for inspection and regulation of mineral exploration and mining and other related issues. The State Mineral Enactment provides the States with the powers and rights to issue mineral prospecting and exploration licenses and mining leases and other related matters. As at end 2021, all the States have adopted the State Mineral Enactment (SME) except Sabah.

“Rock material” means any rock, stone, granite, limestone, marble, gravel, sand, earth, laterite, loam, clay, soil, mud, turf, peat, coral, shell or guano within or upon any land, and includes also any bricks, lime, cement or other commodity manufactured there from.

In Peninsular Malaysia, activities relating to “rock material” are governed under the National Land Code 1965. Of relevance are the Quarry Rules which have been made under Section 14 of the National Land Code. As at end 2021, the states of Kedah, Melaka, Sarawak and Sabah have yet to adopt and implemented the Quarry Rules to regulate quarrying activities.

BUSINESS LEGISLATION

In Malaysia, the most common types of businesses are sole proprietorships, partnerships and companies.

SOLE PROPRIETORSHIPS commonly have just one business owner, and only citizens or permanent residents of Malaysia can register. Personal names or trade names can be used as business names, however, certain names, like those associated with royalty or government agencies (i.e. “national”, “chartered” or “di-Raja”) is prohibited. The relevant authorities, such as the Registrar of Business, are empowered to reject any submitted name deemed inappropriate or misleading.

PARTNERSHIPS comprise two or more business partners. Similar to sole proprietorships, only citizens or permanent residents of Malaysia can register partnerships. A partnership agreement is usually drawn up by legal practitioner, which outlines the responsibilities of each partner, conditions of termination and means of resolving intra-partner disputes.

COMPANIES are registered legal entities comprising shareholders that can own property, draw contracts and employ people. The most common type of company in Malaysia is a company limited by shares (public limited and private limited companies).

Private limited companies cannot sell shares to the public, and are distinguished by the appellation “Sendirian Berhad”, shortened to “Sdn Bhd” or “S/B”.

Public limited companies source their capital by selling shares to the public, and are distinguished by the appellation “Berhad”, shortened to “Bhd”.

Companies in Malaysia are governed by the Companies Act 1965 (Now Companies Act 2016), which protects the rights and interests of shareholders and investors, and provides regulations for the incorporation of companies, the formulation of company constitutions, management and closures.

A company must have a minimum of two members, but a private limited company is limited to 50 members (public limited companies have no member limit). A minimum paid-up capital of only RM2 is needed to start a private limited company, while public limited companies need a paid-up capital of not less than RM60mil (if it seeks to be listed on the Kuala Lumpur Stock Exchange Main Board) or not less than RM40mil (if it seeks to be listed on the KLSE Second Board).

Companies and corporations wishing to operate in Malaysia are required to register with the country Registrar of Business, the Companies Commission of Malaysia (CCM). Under CCM’s regulations, for local and foreign enterprises, there are different procedures.

Local companies firstly must file an application to the CCM to inquire if the intended name is still available for registration. If the name is available, a reservation period of three months will be granted, during which time the company should submit copies of documentation amongst others the company Memorandum and Articles of Association (MMA), Statutory Declaration of Compliance and Statutory Declaration, plus relevant fees. CCM will issue a certificate of incorporation once registration procedures are completed and approved. Companies must file registers of members, directors, managers, secretaries and interest holders with CCM at all times.

Foreign companies are required to register a branch or set up a local company in Malaysia in order to conduct business in the country. The company must also undergo the same procedure as a local company, which is to put an application to inquire if the intended name is still available. A reservation period of three months will also be granted, during which time the company must submit copies of documentations such as Certificate of Incorporation, Company Charter, List of Directors, a memorandum of appointment authorising a Malaysian resident to accept any notices served on the company and Statutory Declaration, plus relevant fees. Documents in a language other than the country’s national language, Bahasa Malaysia or English must have an accompanying certified translation. Once all procedures are completed and approved, CCM will grant the applying company the status of a foreign company operating in Malaysia.

Fiscal Regimes

Incentives and tax concessions have long been an important instrument of Malaysia’s economic development strategy. The Malaysian Government has reduced corporate tax from 28% in 1998 to 24% in 2021. This move has helped to reduce further the cost of doing business and accorded companies with greater capacity to expand capital spending.

Some of the other incentives / tax concessions that have been granted to companies operating in the country are as follows;

Pioneer Status – A company which is granted “Pioneer Status” obtains very favorable fiscal treatment in respect of income derived from “promoted activities” or “promoted products”. What constitutes a “promoted activity” or a “promoted product” is determined by the Minister of Finance and published in the Government Gazette.

Pioneer status may be considered amongst others, in the following cases;

- Where a manufacturing company is capable of achieving world class standards in terms of product quality, product price and capacity it will be eligible for pioneer status with a 100% tax exemption on statutory income for a period of up to 10 years. Smaller manufacturing companies are eligible for a 100% tax exemption on statutory income for a period of 5 years;

- A high technology companies, being defined as companies in which at least 7% of the work force are science and technical graduates and of which research and development costs amount to 1% of gross sales is eligible also for pioneer status. 100% of the statutory income of high technology companies is exempted from tax for a period of 5 years;

- Strategic projects defined as projects of national importance which involve heavy capital expenditure, long gestation periods, high levels of technology and have a significant impact on the economy. 100% of the statutory income of a company engaged in a strategic project is exempted from taxes for a period of 10 years;

- Applications received from 13 September 2003 from existing locally-owned companies that reinvest in the production of heavy machinery such as cranes, quarry machinery, batching plant and port material handling equipment, are eligible for pioneer status with a tax exemption of 70% (100% for promoted areas) on the increased statutory income arising from the reinvestment for a period of five years.

- Research & Development Companies: Such companies as defined by law are entitled to pioneer status with full tax exemption on statutory income for a period of 5 years;

- Companies engaged in software development can obtain pioneer status for a period of 5 years with a 100% exemption from taxes on business income provided that the software is for a general purpose and not customized (i.e. for only one client) and where existing software has been modified provided the cost of acquiring the existing package does not exceed 25% of the modification expenditure;

Double Deduction Tax Incentives – Expenses incurred on certain activities can also be set off twice against taxable profits. Among these activities includes;

- Promotion of Exports – Expenses which are aimed at promoting exports and the supply of goods overseas can be deducted twice from taxable profits. The list of allowable expenses are set out in the income tax legislation and include overseas advertising, export market research, preparation of tenders for the supply of goods overseas, overseas travel and accommodation, cost of maintaining overseas offices & approved industrial exhibitions. This incentive is available to manufacturing & agricultural companies producing “promoted products” or engaged in “promoted activities”. The allowance is also available to the tourist industry in respect of costs incurred in the overseas promotion of Malaysia as a tourist destination.

- Employee Training Programs – Expenditure incurred by manufacturing companies on government approved training programs designed to develop and upgrade skills to modernize manufacturing processes can be deducted twice from taxable profits. This incentive is available to manufacturing companies & companies engaged in the hotel and tourist industry.

- Research & Development – All expenditure incurred on government approved research, payments made for the use of services of approved research institutes and voluntary cash contributions made to approved research institutes can be deducted twice from taxable profits.

- Freight Charges – Certain manufacturing industries located in certain regions of the country (e.g. timber companies in Sabah) can deduct double the amount of freight charges incurred.

- Brand Promotion Advertising – Expenditure incurred promoting an export quality standard Malaysian owned product is subject to double tax deduction. Promotion of a brand name means making a name internationally known and therefore would include such expenditure as bill-boards in international airports or highways. The company must be 70% Malaysian owned and the product must achieve export quality standards. This incentive is available to manufacturing companies.

For projects deemed as strategic and of national importance, the Government may consider granting other incentives such as;

Investment Tax Allowance – An allowance of 60% (80% for Sabah, Sarawak, Labuan and designated Eastern Corridor of Peninsula Malaysia) of qualifying capital expenditure incurred during the first five years. The allowance can be utilized to offset against the 70% (85% for Sabah, Sarawak, Labuan and designated Eastern Corridor of Peninsula Malaysia and 100% for high technology companies) of the statutory income in the year of assessment. Any unutilized allowance can be carried forward to the following year until the amount has been used up.

Reinvestment Allowance (RA) – An allowance of 60% of capital expenditure incurred by the companies. The allowance can be utilized to offset against the 70% (100% for Sabah, Sarawak, Labuan and designated Eastern Corridor of Peninsula Malaysia and companies which can improve significantly in productivity) for of the statutory income in the year of assessment. RA is given for a period of 5 years beginning from the year of first reinvestment is made. Upon expiry of RA, companies producing promoted products/engaging in promoted activities are eligible for Accelerated Capital Allowance on capital expenditure where 40% of initial rate and 20% of annual rate will enable capital write off within 3 years.

Malaysia Foreign Direct Investment (FDI) regime is tightly regulated in that all foreign manufacturing activity must be licensed regardless of the nature of the business in which it is engaged. The foreign equity restrictions in Malaysia are not determined by a law or an act. Malaysia instead has a Foreign Equity Guidelines. This has allowed the Government maximum policy and regulatory space to screen and control FDI to suit the economic and industrial needs of the country at a given particular time.

Foreign investors exploring minerals in Malaysia are permitted to control 100% equity and can also form joint ventures with local companies. Total equity participation is also permitted for extraction, mining and processing of ores, depending on a case-to-case basis.

Amongst some of the incentives that has been accorded to the mineral sector includes abolishing the export duties on most minerals, and most raw minerals, including ores and concentrates, are subject to low or zero level import duties. For those minerals still subject to import duties, the importer may apply to the Government for a waiver. Imported equipments for use in mineral projects are subject to the general schedule of import tariffs but an application for a waiver may be made on a case-by-case basis.

On major mineral commodities, apart from paying corporate tax to the Federal government, mine and quarry operators also pay value-based royalties to the state where their operation is located. Royalty rates may varies depending on the mineral commodity and as assessed by each of the individual states.

The Malaysian government is now urging miners to revive abandoned mines, especially tin mines, while also encouraging the states to issue more mining licences. Every state is responsible for the issue of mining licences in consultation with federal agencies such as the Department of Minerals and Geoscience and the Department of the Environment. Recent Policy updates, such as preference in the grant of exploration rights to existing holders of mining licences, is an additional encouragement for local mining contractors to stay in business. A schedule of area-based land premiums and rental fees, processing and application fees for mining lands is published in each State.